The Southeast's venture capital landscape is showing encouraging signs of stabilization in Q3 2024, marking a significant recovery from the market turbulence of 2022-2023. After the unprecedented peaks of 2021-2022, when funding reached nearly $41.7 billion from 2021-2022, the region has found a more sustainable equilibrium around $20 billion from 2023-2024*. This recalibration represents not a retreat but rather a return to more sustainable funding levels that better reflect the true value of the region's startups landscape

Deal velocity has similarly stabilized, with the number of transactions finding a steady rhythm across the region. While down from the frenzied pace of 2021-2022, when deal counts in states like Florida and North Carolina reached all-time highs, current activity levels suggest a more measured and disciplined approach to deployment. This stability in deal flow indicates that while investors may be more selective, they remain actively engaged in the market, particularly at the early stages where deal counts have shown remarkable resilience.

Historical growth patterns reveal impressive momentum across the Southeast. Alabama (124.2% CAGR), Virginia (111.7%), South Carolina (108.9%), and Tennessee (108.7%) all achieved remarkable growth from 2014-2023. Current performance continues to impress, with several states showing strong year-over-year gains in 2023: Tennessee (+58.77%), Kentucky (+45.13%), and Alabama (+10.68%). The momentum has carried into 2024, with North Carolina already exceeding its 2023 total by 20%, South Carolina surpassing its previous year by 5%, and Florida and Kentucky reaching 80% and 86% of their 2023 totals respectively.

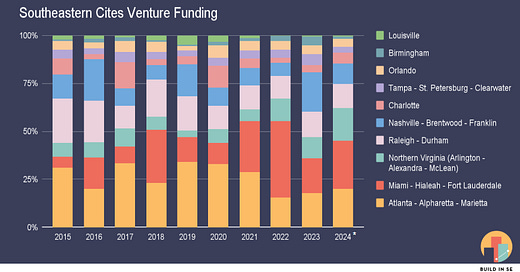

The Southeast's major metro areas show diverse venture capital growth patterns. Atlanta and Miami lead with $15.57B and $13.86B in total funding through 2023 respectively. Miami maintained strong growth (218.19% pre-COVID, 18.62% post-COVID), while Atlanta showed more variation (117.78% pre-COVID, -10.62% post-COVID).

Other cities demonstrate robust ecosystem development. Nashville shows strong healthcare-tech growth (90.84% YoY, 26.34% post-COVID), while Birmingham leads post-COVID growth at 30.38%. Northern Virginia and Raleigh-Durham remain stable with $5B+ in funding each. 2024 shows promising recovery, with Northern Virginia reaching 102.38% of its 2023 total, Charlotte 94.61%, and Miami 93.02% through Q3.

Adoptions of SAFES for Cities

SAFE adoption in the Southeast shows growing funding sophistication, challenging traditional views. First popularized by Y Combinator in 2013, SAFEs (Simple Agreement for Future Equity) have become increasingly prevalent due to their founder-friendly characteristics - they're simpler than convertible notes, don't accrue interest, have no maturity dates, and allow founders to defer valuation discussions until a priced round.

Miami-Fort Lauderdale leads the Southeast at 83% adoption (close to Bay Area's 87%), followed by Orlando (77%), Charlotte (74%), Atlanta (69%), Nashville (67%), and Research Triangle (60%). Each city exhibits unique characteristics: Orlando extends beyond entertainment tech, Charlotte blends traditional banking with modern practices, Atlanta focuses on enterprise tech, Nashville emphasizes healthcare innovation, and Research Triangle aligns with deep tech needs. Instead of mimicking Silicon Valley,

Southeast hubs have developed distinct funding approaches, combining modern instruments with traditional business discipline—creating a unique advantage in the maturing venture ecosystem.

Notable Deals of Q3

Pre-Seed

why?! (Decatur, GA): $1.65M Question-based conversation platform. Backed by BluePrint, Bistro Partners, SISTER, with Clubhouse, Bain Capital Ventures participating.

Seed Rounds:

De Novo Foodlabs (Raleigh, NC): $1.5M Animal-free dairy products. Led by Joyful Ventures, with UM6P Ventures, Siddhi Capital.

Kinto (Orlando, FL): $5M Secure blockchain financial services. Led by Blockchain Capital, with Velocity Capital.

GovPort (Annandale, VA): $5.3M Contractor collaboration platform. Led by QED Investors, Susa Ventures, PruVen Capital.

District Cover (Nashville, TN): $7M Insurance for underserved small businesses. Led by Mosaic General Partnership, with AmWINS, Andreessen Horowitz.

BeMe Health (Miami, FL): $14M Mental health app for teens. Led by Flare Capital Partners and Polaris Partners.

BitFi (Asheville, NC): $50M CeDeFi platform for optimizing crypto returns. Backed by AILayer, zkLink, CGV FoF.

Series A:

NAVIGANTIS (Miami, FL): $12M Neurovascular care and surgical robotics. Led by Puma Venture Capital, with Cormorant Asset Management.

Arcee.ai (Miami, FL): $24M Domain-adapted LLMs for businesses. Led by Emergence, with Centre Street Partners, Long Journey Ventures.

Graphyte (Memphis, TN): $37.77M Carbon removal tech. Led by Carbon Direct Capital Management and Prelude Ventures.

Series B:

Pathalys Pharma (Raleigh, NC): $105M Kidney disease treatments. Led by TCG Crossover Management, with DaVita Venture Group, JPMorgan Life Sciences Private Capital.

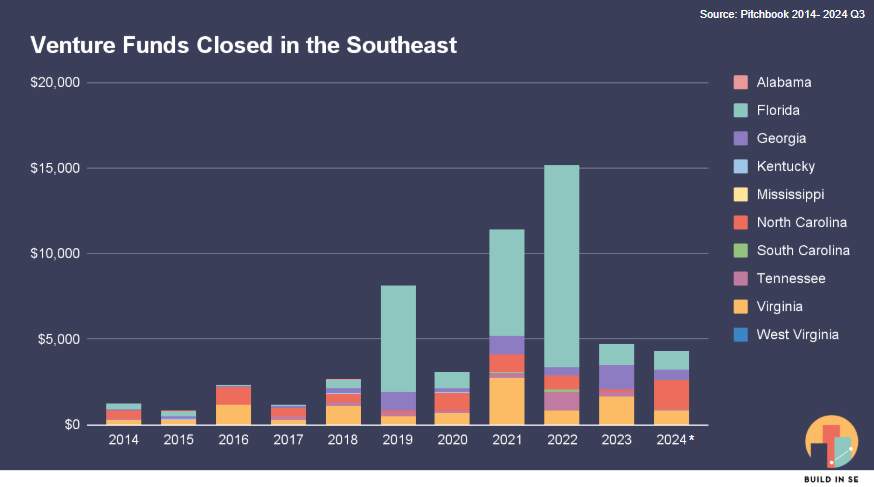

Venture Funds in the Southeast

The Southeast's venture fund landscape demonstrates strong post-COVID growth across multiple states. Georgia leads the region with a 31.68% CAGR (2015-2023) and the highest post-COVID growth rate at 122.10%. Florida and Virginia showed remarkable acceleration—Florida's growth increased from 63.51% pre-COVID to 102.45% post-COVID, while Virginia's jumped from 8.67% to 104.90%. North Carolina experienced the most dramatic transformation, shifting from -17.74% pre-COVID to 111.17% post-COVID. Tennessee displayed consistent strength throughout, maintaining solid growth rates of 41.05% pre-COVID and 76.26% post-COVID.

This broad-based acceleration signals a fundamental transformation in the region's venture capital ecosystem, with the COVID period serving as a catalyst for heightened investment activity.

Notable Q3 2024 Venture Funds Closed

Boldstart Ventures (Miami, FL)

Fund size: $250M (Fund VII)

Stage: Pre-seed to early-stage ($500K-$5M initial checks)

Focus: Enterprise technology stack

HIPstr (West Palm Beach, FL)

Fund size: $100M

Stage: early stage investment arm of HighPost Capital

Focus: High-growth, capital-efficient companies

Notable: Already made six Series A investments including Closer, Sprinter, Wild Common, EverFence, RAD and After.com

Sovereign's Capital (Atlanta, GA)

Fund size: $60M (Fund IV)

Stage: Seed and Series A (up to $4M per investment)

Focus: B2B/B2C software, fintech, healthtech, deep tech, and tech-enabled services

Ani.VC (Miami, FL)

Fund size: $35M

Stage: Early-stage

Focus: Pet and animal health technology

Thanks for exploring our Southeast Q3 2024 Venture Report! Questions or recommendations? Feel free to reach out to evan@buildinse.com, who put this report together.

The Southeast's entrepreneurial story keeps getting better, and we'd love for you to be part of it. Discover more opportunities through our Build In SE website or follow our latest insights on Substack.