Southeast Q4 2024 Venture Report

Zoom Out: 2024 showed us that venture capital is starting to find its footing again, though we're definitely not back to the crazy days of 2021. Here's what's happening at the national level:

The Numbers: VCs invested $209 billion across 15,260 deals in 2024. While that's better than 2023, it's still way below what we saw during the zero-interest-rate party of 2021.

The Big Got Bigger: The really interesting story is how concentrated the money became. Get this - in just the last quarter of 2024, five companies (mostly AI) took home 43% of all the venture money. That's a lot of eggs in a few baskets!

Fundraising Got Tougher: Companies are having to wait longer than ever between funding rounds - we're talking about two years for later-stage companies. Unless you're working on AI or are already a market leader, raising money took serious patience.

Zoom In: the Southeast venture capital landscape showed some slight variance in 2024. Total venture funding contracted by 29.75%, dropping from $11.73B to $8.24B, while deal count declined by a more modest 10.90%. Despite the decline, several states demonstrated exceptional growth.

State Performance: Four states led the region with extraordinary funding growth:

North Carolina: +202%

South Carolina: +154%

Kentucky: +102%

Florida: +100%

Notably, all southeastern states recorded positive funding growth from 2023 to 2024, demonstrating the region's robust fundamentality.

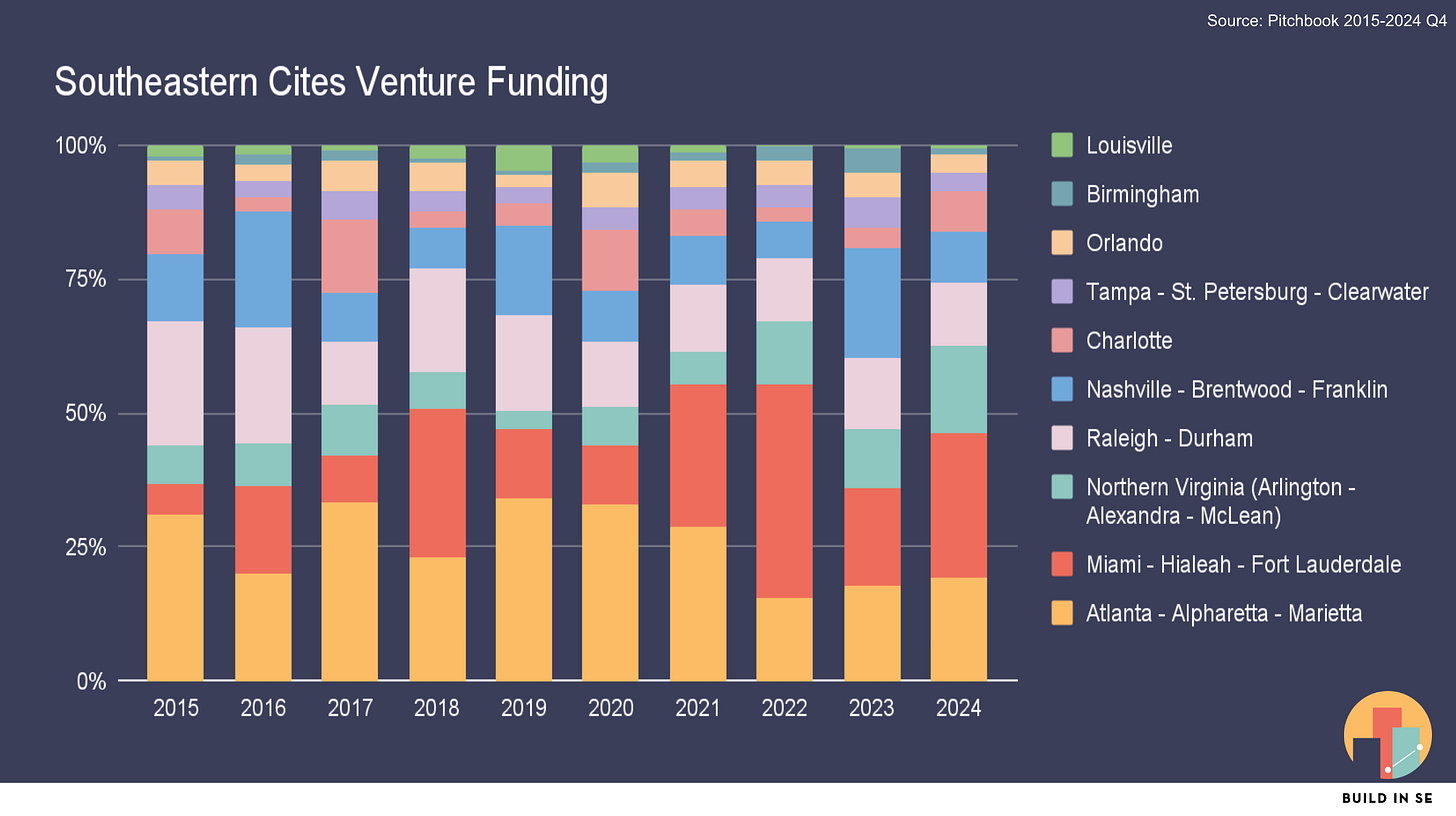

Metro Area Dynamics

Metropolitan performance varied significantly from 2023 to 2024

Strong Growth:

Charlotte: +60%

Miami: +23%

Northern Virginia: +22%

Significant Contractions:

Birmingham: -81%

Nashville: -62%

Tampa: -52%

Investment Focus: AI and SaaS dominate the regional investment landscape, capturing 24% and 22.81% of company distribution respectively. FinTech and HealthTech follow closely, each representing approximately 9% of companies in the ecosystem. This distribution reflects the Southeast's growing strength in enterprise technology and financial innovation.

Notable Deals of Q4

Pre-Seed Rounds

Warrant (Durham, NC) raised $125K from Brickyard and Triangle Tweener Fund for their automated marketing compliance platform for fintech and financial services.

Incora Health (Greenville, SC) secured $500K from FortySix Venture Capital, Sound Media Ventures, and XRC Ventures for their AI-powered smart earring that tracks women's biodata.

Smover (Charleston, SC) received EUR 15K through Startupbootcamp for their AI-powered real estate platform, with additional partnerships from NVIDIA Inception and Google for Startups.

blinder (Davidson, NC) developed an AI-powered data privacy platform using differential privacy and federated learning (funding amount undisclosed).

Seed Rounds

Archive Intel (Alpharetta, GA) raised $1.5M from angel investors for their AI-powered regulatory compliance solution for financial advisors.

Spidr (Charlotte, NC) secured $1.65M led by Co-Founders Capital for their platform connecting emerging fintechs with top payment processors.

reelist (Norfolk, VA) raised $2.65M from RedBud VC for their social platform-based HR hiring tools.

Mudstack (Roswell, GA) raised $4M in Seed-4 funding at a $12M pre-money valuation led by Anthos Capital, with participation from Hyperplane Venture Capital, Khosla Ventures, and Andreessen Horowitz for their game studio asset management platform.

Acre (Durham, NC) raised $10M from Sovereign Capital, Front Porch Ventures, Studio VC, Unpopular Ventures, and Triangle Tweener Fund for their flexible homeownership platform.

Alchemy Health (Charlotte, NC) secured $31M led by Andreessen Horowitz, with participation from AlleyCorp, Twine Ventures, Sandberg Bernthal Venture Partners, Magic Johnson, and others for their in-house pharmacy platform for safety net providers.

Series A

Infinant (Charlotte, NC) raised $15M led by FINTOP Capital and JAM FINTOP for their embedded finance tools platform.

Ask Sage (Bentonville, VA) raised $17M from Mucker Capital and Sapphire Ventures for their generative AI assistant for government and corporate teams.

Backflip AI (Miami, FL) secured $30M from Andreessen Horowitz and NEA for their 3D generative AI platform for physical world design.

Series B

Looma Project (Durham, NC) secured $10.06M from Triangle Tweener Fund and YETI Capital for their in-store digital storytelling platform.

Document Crunch (Atlanta, GA) secured $21.5M at an $80M pre-money valuation led by Titanium Ventures, with participation from Nemetschek Group and others for their AI-powered construction contract review platform.

Slip Robotics (Norcross, GA) raised $28M from DCVC and Overline for their robotic trailer loading/unloading technology.

Aiwyn (Charlotte, NC) raised $113M led by Bessemer, KKR, and Operator Partners for their accounting firm automation platform.

Venture funds in the southeast remained resilient, dropping just 6% year-over-year in closures.

Charlotte Fund ($60M)

Focus: Seed-stage tech startups in Charlotte Metro and later-stage companies across the Carolinas

Notable: 50% larger than Fund I

Strategy: 80/20 split between later stage and seed investments

Key Feature: Over 50% capital from local founders

Focus: Early-stage tech investments

Model: Fund-of-funds approach for family offices

Strategy: Sector-specific investments across fintech, AI, and logistics

Second fund closing, demonstrating continued commitment to regional innovation

Market Outlook: Despite mixed signals in overall funding, the Southeast continues to demonstrate resilience and growth potential, particularly in technology-focused sectors. The region's ability to attract new fund formations and maintain steady deal flow suggests a maturing ecosystem poised for continued development.

Thanks for exploring our Southeast Q4 2024 Venture Report! Questions or recommendations? Feel free to reach out to evan@buildinse.com, who put this report together.

The Southeast's entrepreneurial story keeps getting better, and we'd love for you to be part of it. Discover more opportunities through our Build In SE website or follow our latest insights on Substack.